[ad_1]

Obtain free Markets updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the newest Markets information each morning.

This text is an on-site model of our Unhedged e-newsletter. Join right here to get the e-newsletter despatched straight to your inbox each weekday

Good morning. This morning’s payroll report has the potential to maneuver markets much more than typical. Whether it is wherever close to as scorching as yesterday’s ADP employment report, the pervasive optimism of the previous few weeks would possibly get sucked proper out of the air. A reasonable report may maintain the nice vibes flowing. Deep breaths, everybody. E-mail us: robert.armstrong@ft.com and ethan.wu@ft.com.

One thing has modified

Up to now week or two, one thing vital appears to have occurred in markets. As with every short-term transfer, the adjustments may very well be noise or a short lived byproduct of shifting investor positioning. However it feels extra important than that.

The background to the market shift is financial knowledge that has been coming in sturdy. We’ve mentioned final week’s spectacular sturdy items and gross home product numbers. And simply yesterday:

-

The ISM providers index popped to 54 in June, indicting growth, up from a impartial 50 in Could, and nicely above forecasts.

-

The quits charge, which had been returning to a its pre-pandemic common of two.3 per cent, ticked again as much as 2.6 per cent.

-

Job openings fell, however at a considerably reserved tempo. They continue to be greater than 40 per cent above 2019 ranges. There may be plenty of labour demand nonetheless on the market.

-

The ADP personal payrolls report confirmed practically half 1,000,000 jobs added in June, suggesting right this moment’s authorities payrolls knowledge may are available in scorching too (ADP’s numbers are notoriously noisy, although).

The essential change in markets is in Treasury yields. Since early Could, two-year yields have been rising steadily, as buyers have slowly accepted the truth that the Federal Reserve won’t minimize its coverage charge any time quickly. Neither the debt ceiling set-to nor the meltdown of some regional banks had an considerable impact on the economic system; inflation had declined however solely at a stately tempo; monetary markets have churned increased, loosening monetary situations. The Fed doesn’t have room to chop.

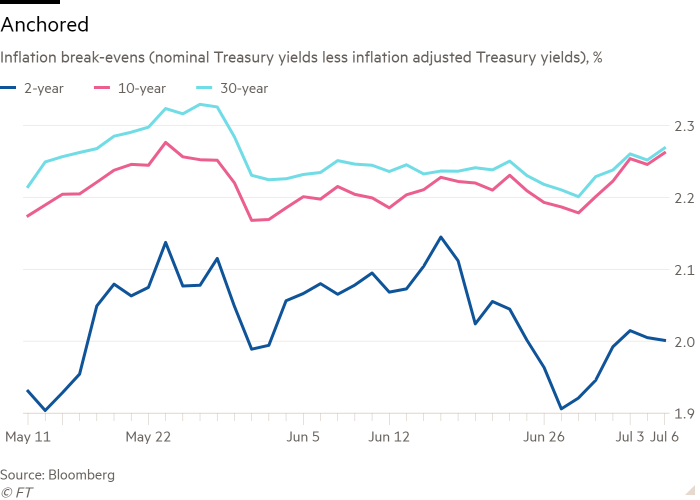

Up to now few weeks, the rise in two-year yields has solely accelerated. What has modified is that longer-term Treasury yields have began to rise too, and rise in a short time. See how the pink and lightweight blue strains — 10- and 30-year bonds — have connected sharply after many weeks of operating sideways:

The rise in lengthy charges isn’t a surprise in itself. As expectations that the fed funds charge will stay excessive for longer change into entrenched, it turns into more durable for lengthy charges to disregard them and keep low. Lengthy charges are only a collection of brief charges, plus a variable time period premium. What is a bit stunning is that this has occurred coincidentally with two different info: inflation expectations haven’t risen, and inventory costs have.

Right here is why that mixture is stunning. If progress continues to be sturdy after 500 foundation factors of will increase within the fed funds charge, the Fed most likely goes to need to do fairly a bit extra tightening to chill the economic system. This, presumably, will increase the danger they may screw up the timing and tighten an excessive amount of, inflicting a recession. However the rising inventory market says this isn’t going to occur.

Alternatively, possibly the Fed has overestimated how tight their coverage is — possibly the inflation-neutral charge of curiosity is increased than the Fed thinks — and subsequently will fail to tighten coverage sufficient, permitting inflation to persist. However low and secure inflation break-evens are telling you that’s not going to occur, both. Break-even inflation charges (Treasury yields minus inflation-indexed Treasury yields) have been shifting kind of sideways for 2 years. The latest improve in rates of interest is subsequently largely a rise in actual rates of interest.

The latest quick rise in long-term actual charges is the concrete manifestation of the assumption that the Fed will finally pull off a tender touchdown — decrease inflation with out recession. This perception was once summary, a quantity in a likelihood matrix or a chart in a paper by a Fed official. As of this month, it’s a concrete reality, inscribed in market costs.

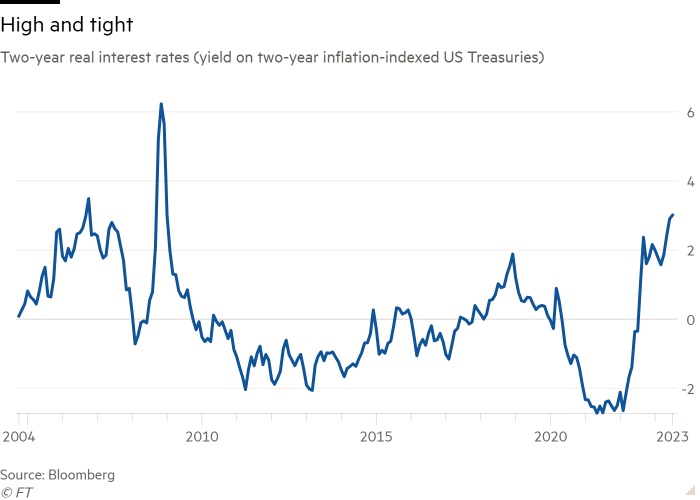

Has the market change into too optimistic? Yesterday’s buying and selling featured rising charges and — for a change — falling inventory costs. That mixture suggests second ideas, a twinge of concern about Fed-induced recession. And second ideas are so as. Brief time period actual rates of interest at the moment are increased than they’ve been because the nice monetary disaster:

The chart above is sufficient to make an individual doubt how lengthy the excellent news on progress will proceed — or marvel if financial coverage is now not as efficient because it was. [Armstrong and Wu]

One good learn

Fifteen years in the past, the final time two-year rates of interest have been this excessive, Unhedged pal and rival John Authers wrote this evaluation with one other pal, Mike Mackenzie. Elements of it proved unpleasantly prescient concerning the disaster that was then lower than a yr away. Does it have classes for right this moment? We certain hope not.

FT Unhedged podcast

Can’t get sufficient of Unhedged? Hearken to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the newest markets information and monetary headlines, twice per week. Compensate for previous editions of the e-newsletter right here.

Beneficial newsletters for you

Swamp Notes — Knowledgeable perception on the intersection of cash and energy in US politics. Join right here

The Lex E-newsletter — Lex is the FT’s incisive each day column on funding. Join our e-newsletter on native and international traits from knowledgeable writers in 4 nice monetary centres. Join right here

[ad_2]

Source link