[ad_1]

This text is an on-site model of our Vitality Supply e-newsletter. Join right here to get the e-newsletter despatched straight to your inbox each Tuesday and Thursday

Welcome to a different Vitality Supply.

The Opec+ oil worth enhance appears to be fading. Worldwide benchmark Brent settled at simply over $83 a barrel yesterday, down 2 per cent on the day and leaving it solely 4 per cent above its stage earlier than the cartel introduced its shock cuts earlier this month. The value is now decrease even than simply earlier than Opec+ introduced its 2mn price of cuts in October. Much less provide for a cheaper price: ouch!

What’s occurring? The potential of extra rate of interest rises from the US Federal Reserve, coupled with underlying — and associated — fears about recession imply the macro backdrop stays bearish. A variety of weak financial institution earnings reviews yesterday triggered a broader sell-off in fairness markets too. That’s hurting oil costs regardless of indicators of a resurgence in China’s economic system and forecasts for a surge in world oil demand later within the 12 months. And picture the place oil costs could be if Saudi Arabia hadn’t pushed Opec+ to chop provide over current months.

The relative weak point of oil and gasoline costs would possibly recommend that the nice vitality disaster that threatened a lot hurt to economies in Europe and elsewhere has handed. Perhaps. However oil might but spring a shock this 12 months. That’s our first observe.

Myles picks over the first-quarter earnings from Baker Hughes — and tells us what to anticipate from the vitality sector this quarter. And Amanda takes on hydrogen and the Inflation Discount Act in Information Drill.

Is that this vitality disaster over?

Hovering gasoline costs in Europe final 12 months threatened financial disaster and political disarray.

As my colleagues Shotaro Tani and Laura Dubois reported this week, Europe has defied Moscow’s makes an attempt to induce pure gasoline shortages on the continent. Storage ranges are at their highest stage for this time of 12 months since 2011.

“It seems like Europe goes to have an excessive amount of gasoline round this summer season reasonably than the opposite means round,” mentioned Natasha Fielding, head of European gasoline pricing at Argus Media, within the piece.

The abundance is surprising, contemplating what might need occurred. At one level final 12 months, European pure gasoline hit a document worth of greater than €343 per megawatt hour ($100 per million British thermal models). Yesterday, they traded at about €40/MWh, nearly 90 per cent decrease.

How Europe averted the worst is now nicely understood. Demand dropped as vitality intensive industries slashed consumption and even shut capability: a painful type of rationing that can go away lasting scars on the continent’s industrial sector. Provide from the US, Norway and others helped exchange Russian vitality. Unseasonably heat climate undermined Vladimir Putin’s plan to induce a Nineteen Seventies fashion vitality shock.

It now appears that, as Worldwide Vitality Company boss Fatih Birol informed me final 12 months, Russia has certainly “misplaced the vitality battle”. And as we famous in ES earlier this week, even the G7’s worth cap on Russian seaborne oil exports appears to be outperforming expectations. Oil costs are about 25 per cent decrease than they had been a 12 months in the past.

However are shopper economies out of the woods? Removed from it — at the very least within the oil market.

Bearish sentiment and worth actions based mostly on speculative bets are one factor. And the form of the oil futures curve doesn’t present a lot alarm — costs for oil to be delivered months sooner or later are cheaper than spot costs. However this can be a puzzle, as a result of the basics of provide and demand look way more bullish later this 12 months.

International demand can be 2.6mn barrels a day larger within the fourth quarter than within the first quarter, the IEA believes, because it units a brand new annual document nicely above 100mn b/d. Opec expects the demand leap to be comparable, however to occur much more rapidly, between the second and fourth quarters.

Neither of those forecasters thinks provide will sustain.

We’ve written repeatedly in current months concerning the struggles within the shale patch, beforehand a swing provider. However take into account that between now and the tip of the 12 months, the US’s Vitality Info Administration expects the nation’s output to rise by lower than 100,000 b/d — a fraction of the availability development price of the pre-pandemic increase years.

In the meantime, Opec+ has pledged to chop greater than 1mn b/d from its provide from Could by means of to the tip of the 12 months. The IEA expects all this to imply that world provide between the primary and fourth quarters will rise by simply 300,000 b/d or so. If all this holds true, oil should be drawn from shares to match demand.

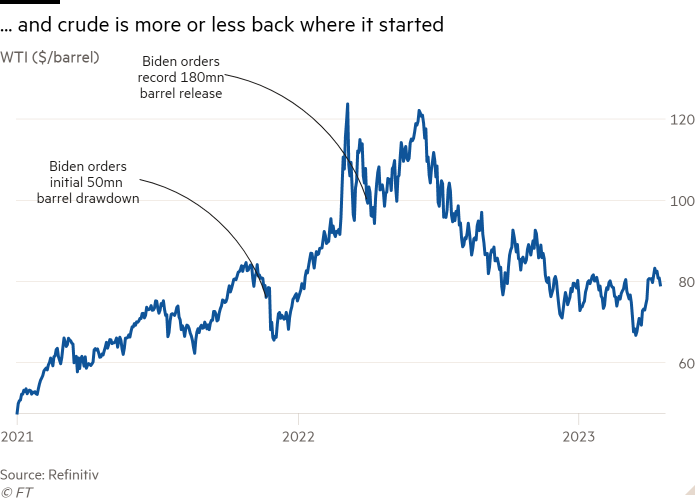

As costs rise, the US may need it had a extra strong emergency stockpile at hand. The Biden administration first introduced its plan to start depleting the Strategic Petroleum Reserve in November 2021, when Brent crude costs had been buying and selling within the mid-$80s and US petrol costs averaged about $3.40 per gallon.

Brent is a few bucks cheaper now. And gasoline costs a number of cents dearer. However the SPR — designed for emergencies — is at its lowest stage because the early Eighties.

The US will solely start shopping for crude to replenish the SPR later this 12 months, in accordance with vitality secretary Jennifer Granholm. That can be proper concerning the time when analysts count on a tighter market to push crude costs even larger.

Briefly, one vitality disaster — the pure gasoline scarcity — in Europe could have handed, for now. However financial legal guidelines of provide and demand haven’t been vanquished. Fears of recession and worries about demand could also be ruling oil costs, however provide is getting quick. The second half of the 12 months might be bumpy. (Derek Brower)

Shale patch slowdown

Earnings season is upon us once more.

Oilfield companies group Baker Hughes kicked off proceedings yesterday, with a greater than anticipated set of outcomes fuelled by its Center East and liquefied pure gasoline companies.

Baker boss Lorenzo Simonelli was bullish, predicting a “double-digit improve” in world upstream spending this 12 months and momentum enduring afterwards too.

“We proceed to consider that the present surroundings stays distinctive, with a spending cycle that’s extra sturdy and fewer delicate to commodity worth swings, relative to prior cycles.”

Now all eyes can be on the opposite massive worldwide service suppliers, SLB (the artist previously referred to as Schlumberger) and Halliburton, which report within the coming days. Collectively, these firms act as a bellwether for the oil trade’s temper and well being.

Analysts can be awaiting proof of slowing exercise within the US shale patch. The rig depend has been on the decline for some months as weaker costs pressured operators to dial again drilling.

Henry Hub gasoline costs have climbed a little bit bit from their current lows, however at $2.35/mmbtu they continue to be down 60 per cent since June. And gasoline drillers are pulling again on rigs and frack crews.

“In North America, exercise has been seasonally weaker to start out the 12 months as anticipated, with a excessive probability of additional softness as exercise in gasoline basins responds to current pure gasoline worth weak point,” mentioned Simonelli.

Oil costs have additionally been shaky in current months, drifting down in the direction of break-even ranges for operators. The current shock cuts from Opec+ “removes the extra bearish US shale manufacturing situation that involved traders final month”, famous Chase Mulvehill at Financial institution of America. However the drop in costs yesterday can have sounded some alarms as soon as extra.

The opposite issue to observe from the large three oilfield companies firms is information on their very own pricing. Oilfield companies inflation has soared over the previous 12 months as operators scrambled to find tools. However with demand coming off the boil, the worth rises in oilfield companies have been subsiding.

“There could be some that may push pricing,” mentioned Michael Bradley, a associate at consultancy Veriten. “However I believe the pricing will increase we now have seen over the previous few quarters — its going to be very powerful to push. So we expect pricing goes sideways.”

(Myles McCormick)

Information Drill

A multibillion-dollar debate over the definition of fresh hydrogen is heating up as firms and vitality teams eagerly await the Biden administration’s ruling.

The IRA included hefty subsidies for clear hydrogen, together with a manufacturing tax credit score of $3/kg that immediately made the US probably the most enticing locations for hopeful builders.

However the US Treasury must determine what the IRA means by “clear” hydrogen. Final week, greater than 40 giant hydrogen producers, together with Air Liquide, Linde and NextEra, wrote a letter to the Biden administration calling for a looser interpretation of standards in deciding which tasks get the tax credit score.

For a deep dive on the talk, see this earlier version of Vitality Supply. Briefly, local weather advocates argue that clear hydrogen should use renewable vitality for each hour of manufacturing — with out taking it away from current provide. However some firms and consultancies argue that these measures are pricey and will choke the trade earlier than it could scale up.

A report from Princeton Zero Lab launched immediately rejects this trade-off. The report examined competing research on the tax credit score and located that research calling for a looser implementation had assumed a lot larger prices for electrolysers and electrical energy than consensus estimates. When the report adjusted the research’ findings for outliers, it discovered that greater than half of the research supported stringent interpretations of hydrogen that had been value aggressive.

“What we expect this exhibits is that not solely can there be many tasks which are aggressive proper out the gate, [but] even at the costliest electrolyser prices,” mentioned Wilson Ricks, one of many authors of the report.

Energy Factors

Vitality Supply is written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu and Emily Goldberg. Attain us at vitality.supply@ft.com and observe us on Twitter at @FTEnergy. Compensate for previous editions of the e-newsletter right here.

Really useful newsletters for you

Ethical Cash — Our unmissable e-newsletter on socially accountable enterprise, sustainable finance and extra. Join right here

The Local weather Graphic: Defined — Understanding an important local weather information of the week. Join right here

[ad_2]