[ad_1]

Mortgage rates of interest are anticipated to rise this week, as UK banks and constructing societies worry being swamped by functions from debtors dashing to refinance as market circumstances stay risky, brokers warned.

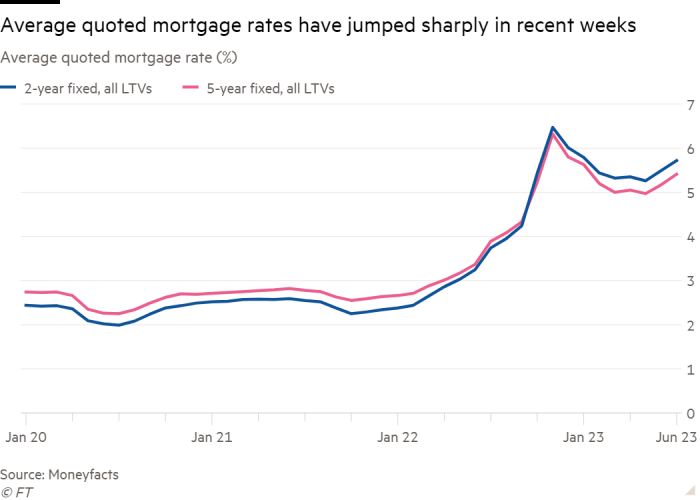

Mortgage charges have leapt prior to now two weeks as lenders have absorbed the implications of gloomy inflation forecasts, piling stress on refinancing owners and first-time consumers already below pressure from increased client costs and vitality prices.

The Financial institution of England, which raised its official rate of interest to 4.5 per cent final month, is more likely to hold its base charge increased for longer to fight rising costs, resulting in raised prices of wholesale funding for lenders.

The vast majority of banks and constructing societies have already raised rates of interest on mounted offers or have pulled mortgage offers from the market together with large high-street names akin to HSBC, Barclays, Santander, Nationwide and NatWest.

Santander lifted charges by as much as 0.43 proportion factors over the weekend. HSBC final week added as much as 0.38 proportion factors to its mortgage rates of interest and Accord, a part of the Yorkshire Constructing Society, raised charges by as much as 0.77 proportion factors.

However brokers anticipate there shall be extra ache to come back. Andrew Montlake, managing director at dealer Coreco, stated that giant charge will increase would result in increased demand for remortgages amongst fearful debtors, resulting in additional charge rises.

Continued volatility in swap charges, which information lenders’ fixed-rate pricing, would discourage charge cuts, he added.

“Folks take a look at the information on rates of interest and determine to repair their mortgage, which creates further demand for the lenders. And the lenders with the most cost effective pricing get inundated so that they put their charges up a little bit bit extra — and off they go once more,” he stated. “By the top of the week, I count on most lenders can have moved charges upwards.”

Common five-year charges have climbed to five.41 per cent from 3.37 per cent over the previous 12 months, in keeping with finance web site Moneyfacts. However the bounce has been sharper in current weeks, with five-year charges transferring up from 4.97 per cent at the start of Could.

Adrian Anderson, director at Anderson Harris, stated his workers had cleared their diaries this week in an effort to course of functions earlier than lenders may pull offers or elevate charges additional, requiring new paperwork and resulting in delays. “I believe there’ll be extra will increase this week, however hopefully not as brutal as these we’ve simply seen,” he stated.

The scope for additional mortgage distress was underlined by analysis on Monday that discovered two in 5 folks with a mortgage had not seen an increase of their month-to-month rate of interest since lenders started elevating charges 18 months in the past. These folks stay protected by a hard and fast charge.

Nevertheless, the survey of two,000 folks launched by funding dealer Hargreaves Lansdown discovered that 48 per cent of mortgage holders stated they might battle if their month-to-month funds rose by as little as £150.

About 1.3mn fixed-rate offers are because of finish in 2023, most below 2 per cent, in keeping with the Workplace for Nationwide Statistics.

Sarah Coles, head of private finance at Hargreaves Lansdown, stated month-to-month funds for these with offers expiring within the coming 12 months would rise by a median of £192. These debtors “face the complete power of the rises in a single single hit,” she stated.

Brokers additionally pointed to the shrinking grace interval between a lender saying a charge change and placing it into impact, with some being withdrawn hours after they have been introduced. Montlake stated the impression on candidates might be devastating.

“Lots of people suppose they’ve bought a quote within the morning and if, for no matter cause, they don’t seem to be contactable for a couple of hours, they’ve misplaced the speed and it’s not inexpensive for them,” he stated.

[ad_2]

Source link