[ad_1]

British expats in EU nations are scrambling to seek out inexpensive choices for remortgaging their UK houses amid excessive rates of interest, as massive lenders have retreated from the market section within the wake of Brexit.

Many UK owners despatched on abroad company postings typically hire out their houses whereas overseas. Lenders will insist their customary residential loans are transformed to “shopper buy-to-let mortgages”, which usually include increased rates of interest. These have risen sharply in latest months, as expectations have grown that the Financial institution of England should preserve its official fee increased for longer to fight inflation.

Nevertheless, competitors within the sector has dwindled after many massive banks stopped providing expat mortgages from early 2020, when the UK’s departure from the EU imposed new regulatory hurdles for British banks providing monetary providers throughout the bloc.

As expat debtors attain the top of a fixed-rate deal and look to refinance, they face rates of interest as excessive as 8 or 9 per cent, based on lenders and mortgage brokers. Some banks are turning away expat remortgage candidates or requests for an even bigger mortgage. Others, however not all, nonetheless provide product transfers, the place a borrower is given a brand new fee provide with the identical lender — however at a lot increased charges than beforehand, they mentioned.

Lorraine McLean, head of buy-to-let mortgages at Guernsey-based financial institution Skipton Worldwide, which stays lively within the buy-to-let mortgage marketplace for non-UK residents, mentioned the financial institution had seen an inflow of demand from debtors whose present lender had provided them “a ridiculous fee” on renewal or none in any respect.

The financial institution mentioned it had seen a 40 per cent rise in completions within the first three months of 2023, in contrast with the identical interval final 12 months. Completions within the 12 months thus far had surpassed the full for 2022, it mentioned.

She gave the instance of 1 latest expat applicant with a £475,000 household house within the north-west of England, who mentioned he had been with a lender for 5 years as an expat on a buy-to-let fee of 4.5 per cent. When the time got here for refinancing, the most effective fee he was provided was 8.5 per cent. “And that was a variable fee. With base charges rising once more a few instances since we spoke, he might be taking a look at nearer 10 per cent now,” she mentioned.

When the UK left the only marketplace for monetary providers, UK-based lenders misplaced the so-called “passporting” rights that allowed them to do enterprise in any EU nation with minimal further authorisation.

One director at a serious lender, who requested to not be named, mentioned: “Earlier than Brexit, UK lenders to people primarily based within the EU — whether or not UK or EU residents — have been solely required to make sure they adopted UK lending guidelines. Now they’ve to indicate they’ve additionally adopted the rules within the borrower’s nation of residence, even when they’re UK residents. There’s no capability or urge for food to do that.”

The lender continued to supply product transfers on expat buy-to-let mortgages, he mentioned, however had stopped lending to new expat prospects or permitting present prospects to broaden their mortgage borrowing.

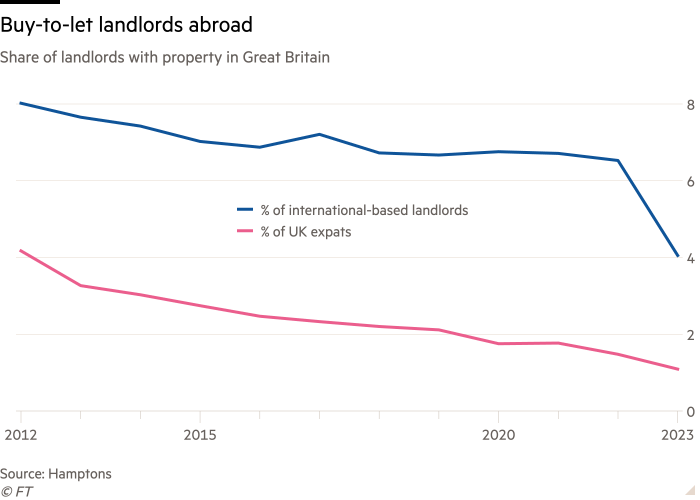

Analysis by Hamptons, an property agent and sister firm of Skipton Worldwide throughout the Skipton Constructing Society group, advised worldwide demand for UK buy-to-lets is declining. It discovered the proportion of internationally-based people amongst buy-to-let landlords was all the way down to 4.1 per cent within the 12 months thus far, in contrast with 6.5 per cent final 12 months and eight per cent in 2012.

Stripping out the non-UK residents from these figures, comparable to Australian or Hong Kong landlords with UK property, British expats accounted for 1.1 per cent of landlords to this point this 12 months, in contrast with 4.2 per cent in 2012.

Most expats who want to proceed proudly owning and letting their UK house whereas overseas, having first lived in it on a residential mortgage, are provided a shopper buy-to-let mortgage after a grace interval of about 12 months from the purpose of their departure. In contrast to loans that have been initially taken out as buy-to-let, one of these mortgage is regulated by the Monetary Conduct Authority.

Those that personal a mortgaged buy-to-let through a restricted firm are unaffected by the regulatory adjustments — although these business debtors too will face increased mortgage rates of interest when refinancing.

For the typical expat, an added hurdle to remortgaging with a brand new lender is the requirement that they cross a mortgage stress check assessing their capacity to repay below rates of interest increased than the deal they’re being provided, to scale back the chance of future defaults. Nevertheless, stress assessments will not be required after they go for a product switch with their present lender.

Ray Boulger, technical supervisor at mortgage dealer John Charcol, mentioned the rationale some lenders have been now not providing product transfers was both due to the excessive prices of upgrading their techniques or the assumption they might be contravening rules.

“For lots of people a product switch would truly work higher,” he mentioned. “For those who took out a mortgage three or 4 years in the past when charges have been decrease, you may need handed the stress check fairly simply. You could now discover you may’t cross the check, so your most borrowing is lowered.”

This text has been amended since publication to replicate the truth that Hamptons and Skipton Worldwide are a part of the Skipton Constructing Society group.

[ad_2]

Source link