[ad_1]

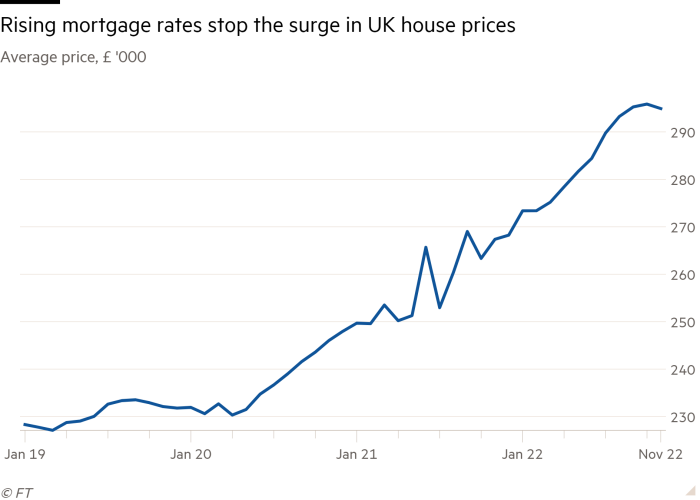

UK home costs reported the primary month-to-month fall in additional than a yr, reflecting the impact of rising borrowing prices on the residential property market.

Home costs dipped 0.3 per cent between October and November, the primary decline since October 2021, the Workplace for Nationwide Statistics mentioned on Wednesday.

This introduced the annual progress fee to 10.3 per cent in November, down from 12.4 per cent within the earlier month, the information confirmed.

The typical UK home value was £295,000, increased than earlier than the onset of the Covid pandemic however a slight lower from October’s document excessive of £296,000.

Mortgage charges have surged up to now few months, reflecting expectations of elevated medium-term borrowing prices because the Financial institution of England seeks to sort out excessive inflation.

The rise in charges has cooled the property market, which boomed through the pandemic when borrowing was traditionally low-cost.

The price of dwelling disaster, ensuing from inflation operating at above 10 per cent, is heaping additional stress on home costs with extra folks struggling to afford a deposit and month-to-month mortgage repayments.

Affordability has additionally been a difficulty for would-be householders for the reason that begin of the pandemic, as home value rises have outpaced wages.

Property costs are on observe for a double-digit fall because the financial downturn “turns into entrenched”, mentioned Andrew Goodwin, chief UK economist at Oxford Economics. Nonetheless, he famous, the robust labour market and excessive share of fixed-rate mortgages would restrict the value correction.

Barret Kupelian, senior economist on the consultancy PwC, expects an 8 per cent fall in home costs this yr, according to the pattern in different superior economies which might be “additionally attempting to deal with low financial progress, excessive inflation and tightening monetary circumstances”.

Separate mortgage information from Nationwide and Halifax confirmed that home costs fell month-on-month in direction of the tip of 2022.

However ONS information revealed that home costs fell extra sharply for money patrons, by 0.4 per cent, with a slower annual value fee of 9.7 per cent, in keeping with the ONS.

The info confirmed that England, Scotland and Wales all registered a month-to-month decline in home costs in November.

London reported the weakest annual tempo of home value progress at 6.3 per cent — lower than half the speed in north-west England, the place they rose 13.5 per cent.

Gabriella Dickens, senior UK economist at Pantheon Macroeconomics, mentioned the capital’s underperformance was possible a mirrored image that “home value to earnings ratios are a lot increased than in the remainder of the nation”.

The ONS information was adopted by the Royal Establishment of Chartered Surveyors’ report on Thursday, which signalled a continued slowdown in gross sales exercise and purchaser demand in December 2022.

The RICS home value stability, which exhibits the distinction between the proportion of survey respondents reporting rises and falls in home costs, slid to minus 42 per cent in December, nicely beneath the minus 26 per cent posted within the earlier month.

The variety of new property listings on the gross sales market declined too, with the extent falling to minus 23 per cent — its lowest since September 2021.

The survey “highlights the rising challenges within the housing market as new patrons grapple with extra pricey finance phrases and uncertainty over the outlook for the financial system”, mentioned Simon Rubinsohn, chief economist at RICS.

[ad_2]

Source link