[ad_1]

Obtain free UK property updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the newest UK property information each morning.

UK home gross sales are set to fall as excessive mortgage charges deter patrons, whereas rental costs surge as tenants enter bidding wars for the few properties obtainable to let, based on a number one property survey printed on Thursday.

The month-to-month report by the Royal Establishment of Chartered Surveyors paints a contrasting image of a slower gross sales market, with each patrons and sellers ready for the financial outlook to settle, and a frenetic rental market the place rising prices and regulation are driving out landlords.

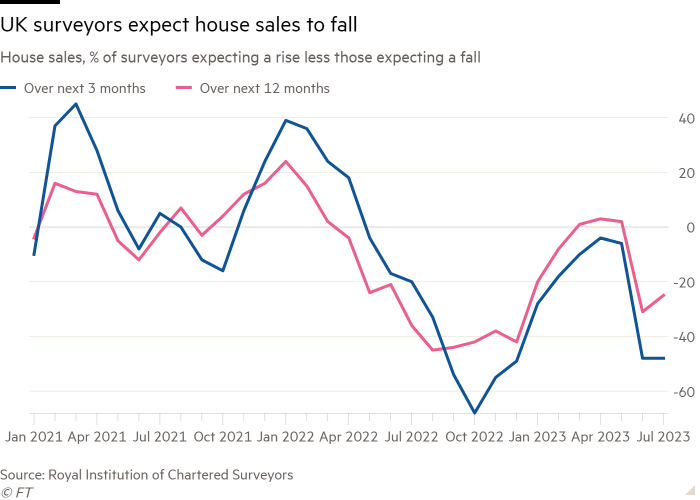

Rics stated its measure of newly agreed gross sales — calculated because the distinction between the proportion of surveyors seeing rises and falls prior to now month — fell to a web stability of -44 per cent in July, down from -36 per cent in June and the weakest because the early phases of the coronavirus pandemic. In contrast with June, an even bigger proportion of surveyors anticipated gross sales to weaken additional over the subsequent three months.

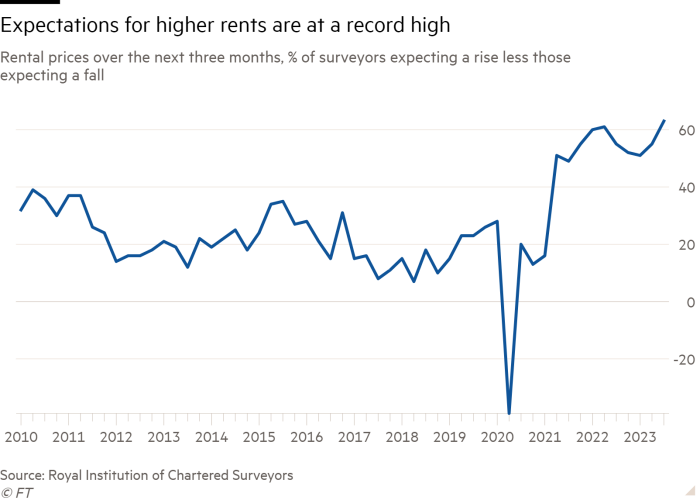

In the meantime, demand from tenants elevated on the strongest tempo since early 2022 and the web stability of surveyors anticipating rental costs to rise within the close to time period hit a document excessive of 63 per cent.

Simon Rubinsohn, Rics chief economist, stated the survey pointed to the challenges dealing with patrons however that it was equally regarding that “rents are prone to proceed rising sharply regardless of the price of residing disaster”.

The slowdown in gross sales exercise displays a pointy drop in each purchaser demand and within the variety of householders itemizing properties.

Surveyors remained gloomy in regards to the outlook for home costs, with a web stability of 49 per cent anticipating them to fall over the 12 months forward, the identical studying as in June. However some prompt the market was extra prone to sluggish than fall, as sellers weren’t but prepared to just accept decrease presents.

“It’s paused relatively than dropping,” stated Andrew Burnett, an agent primarily based in Sussex. Stan Shaw, head of the company Mervyn Smith, primarily based close to Richmond in Surrey, stated patrons had began to make presents nicely under asking costs after the Financial institution of England lifted rates of interest by 0.5 share factors in June, however that the majority sellers have been “not ready at this stage to just accept hefty drops”.

Richard Franklin, an agent primarily based in Tenbury Wells, Worcestershire, stated: “There’s a raft of overpriced rural inventory with distributors failing to understand the market has moved on from WFH and lockdown.”

The BoE stated final week that it anticipated fewer pressured gross sales than in earlier housing market downturns, probably limiting the size of home worth falls. Nonetheless, it stated one issue that might drive down home costs could be rising gross sales of properties by buy-to-let landlords.

A number of respondents to the Rics survey stated they have been now seeing extra landlords exiting the market due to the sharp rise in the price of buy-to-let mortgages, modifications in tax guidelines and different laws, and unease over the potential affect of latest laws supposed to offer tenants extra safety.

“The rental market is damaged,” stated Will Ravenhill, managing director of the Leicester-based lettings company Readings, who noticed many landlords leaving the market, whereas others have been “rising rents to ridiculous ranges to stick to their mortgage covenants”.

Tenants have additionally been staying in properties for longer on common, including to the squeeze on provide.

Kevin Burt-Grey, director on the Pocock & Shaw company in Cambridge, stated most rental properties obtained “a number of functions” inside days of coming to market.

Will Barnes Yallowley, director on the Kensington-based company Tate Residential, cited one case the place a two-bed flat had attracted 11 presents and let nicely above the asking worth inside per week.

[ad_2]

Source link