[ad_1]

Welcome again to a different Power Supply.

All eyes in monetary markets are on the present banking disaster within the US, however thus far the power influence seems restricted. Oil costs offered off onerous on Monday morning after a weekend of spooky headlines triggered fears of wider financial fallout and prompted merchants to dump dangerous commodities. Brent recovered a bit however nonetheless settled down 2.4 per cent at $80.88 a barrel.

Other than Knowledge Drill, the place Amanda appears to be like on the impact on photo voltaic firms’ share costs from the collapse of a financial institution that lent cash to scrub tech builders, the e-newsletter in the present day stays targeted on power.

And yesterday introduced large information. Enterprise World LNG introduced it had taken a closing resolution to go forward with the second section of an enormous liquefied pure gasoline export undertaking in Louisiana. That’s the topic of our first be aware. Our second is on the Biden administration’s resolution to greenlight the Willow oil undertaking in Alaska.

That’s no shock. The federal government needs fossil gas producers to drill extra wells and pump extra oil — no less than for now. US power secretary Jennifer Granholm reiterated that to me in Houston final week, when she in any other case despatched an olive department to EU politicians nonetheless fuming concerning the Inflation Discount Act. Some further feedback from the secretary infuse each our notes in the present day.

Thanks for studying. (Derek Brower)

This text is an on-site model of our Power Supply e-newsletter. Sign up here to get the e-newsletter despatched straight to your inbox each Tuesday and Thursday

US LNG exports put together for lift-off

The race to develop America’s liquefied pure gasoline exports after Russia’s full-scale invasion of Ukraine is selecting up tempo.

LNG developer Enterprise World yesterday dedicated to a giant enlargement of its Plaquemines export facility, which is underneath building on the US Gulf Coast. The whole price of the power is now anticipated to be $21bn and have the capability to show about 2.6bn cubic toes a day, or 2.5 per cent of the nation’s gasoline output, into 20mn tonnes a yr of LNG for exports.

As soon as on-line, it is going to be among the many largest LNG export vegetation on this planet.

What does it inform us concerning the state of America’s LNG enterprise?

Prepare for large development

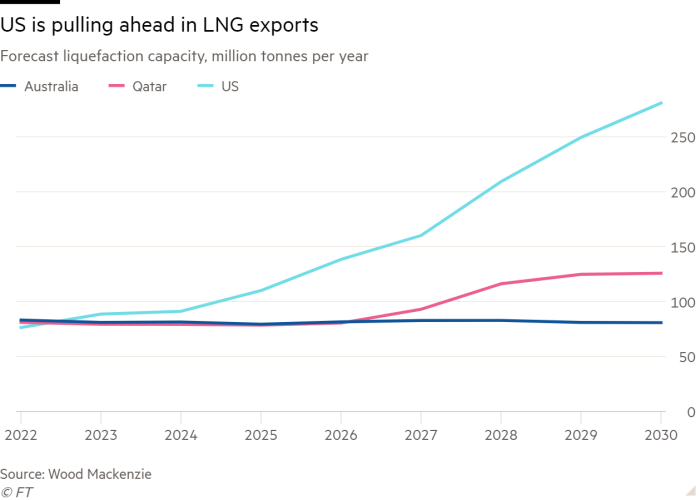

US LNG output is on monitor for an enormous enlargement within the coming years, giving America extra weight to throw round within the world power commerce.

Approval for the enlargement of Plaquemines places complete US LNG export capability on tempo to surpass 20bn cf/d over the following couple of years with the tasks which have dedicated to building. They’ll make the US the world’s largest LNG exporter by far.

The federal authorities has made clear it’s not deterring new tasks. It’s even working with trade to certify gasoline as clear — a approach to cope with its “points” round methane and CO₂, , power secretary Jennifer Granholm informed us final week. That would open up export markets additional.

“It’s a free market and we’re not going to face in the best way,” Granholm stated in an unique interview with Power Supply, noting the “large” quantity of export capability underneath building.

“What’s good is that we’re increasing our means to assist with power safety,” Granholm stated.

A handful of gamers will dominate American LNG

Established LNG gamers are having extra success within the post-Russia invasion panorama than upstarts. The opposite large tasks underneath building are being developed by large gamers like ExxonMobil and Cheniere Power, which lately stated it needs to undertake an enlargement at its Sabine Go plant in Louisiana, already the US’s largest.

Begin-up ventures corresponding to Charif Souki’s Tellurian, in the meantime, are having bother getting off the bottom.

Why? The economics of increasing an present website are higher than constructing new tasks. Additionally, patrons and lenders are flocking to firms with confirmed information in a pricey and high-risk enterprise (see Freeport LNG’s latest prolonged outage after an explosion at its flagship plant.)

Billions are nonetheless on the desk for LNG tasks

The approval for the enlargement of Plaquemines proves that funding is obtainable for large LNG vegetation, together with from monetary establishments with internet zero commitments, regardless of issues about long-term demand for fossil fuels.

Enterprise World stated it raised $7.8bn for the Plaquemines enlargement, from a variety of lenders together with Goldman Sachs, Financial institution of China, JPMorgan Chase, MUFG and Natixis. (Justin Jacobs and Derek Brower)

Willow approval: local weather betrayal or wartime pragmatism?

The Biden administration yesterday gave the inexperienced gentle to ConocoPhillips’s Willow undertaking on Alaska’s North Slope.

Environmental teams have been livid, saying the transfer would lock in contemporary carbon emissions for many years. The oil trade, some native indigenous teams, and Alaskan politicians praised what they stated was a practical resolution that bolsters US power safety.

Willow has develop into a flashpoint for debates within the US about power and local weather coverage — however the undertaking doesn’t actually warrant all of the furore.

Sure, it’s a giant undertaking, however not “large”, to make use of some campaigners’ description.

At its peak, ConocoPhillips says Willow will pump 180,000 barrels a day of oil — about 1.5 per cent of present US output. Nationally, manufacturing is about to develop by greater than double that this yr alone.

It’s additionally smaller than Conoco needed. The inside division was at pains to stress that it had “considerably lowered” the scope of the undertaking — granting Conoco permission for simply three of the 5 drilling pads it had sought.

That stated, the undertaking will pump oil — and emissions — for many years throughout a interval during which the US should in any other case be quickly lowering its carbon air pollution to satisfy its commitments to the Paris local weather accord. The non-profit Earthjustice estimates the undertaking will spew greater than 260mn tonnes of greenhouse gases over 30 years, equal to a yr’s value of emissions from 70 coal-fired vegetation.

On that foundation, the outpouring of anger was comprehensible.

Jeff Ordower of 350.org stated the choice “betrays [Joe] Biden’s personal local weather guarantees”. The environmental organisation’s Invoice McKibben known as it “a savage mistake by the Biden administration, which hopes for a small political enhance”.

However the politics are tough. Whereas some native indigenous teams have opposed the undertaking, many have supported it. Willow would assist guarantee “our indigenous, Alaska Native communities’ 10,000 years of historical past has a viable future”, the native Iñupiat neighborhood stated in an announcement.

Zooming out, America needs extra oil and President Biden says demand will likely be round “for a while”. As Granholm put it final week:

“It doesn’t need to binary. You may be sure to have safety of provide in the present day, while you’re pushing on clear power manufacturing for tomorrow.”

“We’re in the course of a struggle. And there’s monumental volatility. Proper now, it’s essential to supply the provision that may lower that volatility. Subsequent yr, right now, we could also be having a special dialog,” she stated.

The query then turns into: ought to provide come from the US or elsewhere?

“However howls from environmentalists,” stated analysts at ClearView Power Companions, “the greenlighting of Willow would seem to counsel the administration has not but deserted its wartime fossil gas pragmatism”. (Myles McCormick and Derek Brower)

Knowledge Drill

Cleantech teams breathed a sigh of aid on Sunday when the US authorities introduced all deposits at Silicon Valley Financial institution can be assured.

SVB was a outstanding supporter of cleantech, with greater than 1,500 purchasers in local weather expertise and sustainability and $3.2bn invested in undertaking financing, in line with the financial institution. The financial institution’s collapse comes as enterprise capital floods right into a cleantech sector poised for development on the again of tax credit within the Inflation Discount Act.

Shares of Sunrun and Sunnova, two large photo voltaic firms, fell on Friday on information of their publicity to SVB. Mary Powell, chief government of Sunrun, stated the corporate was “happy” the federal government would change its lower than $80mn in money deposits at SVB, including that Sunrun had “longstanding banking relationships” and remained assured in its means to interchange SVB’s undrawn commitments.

Sunnova stated its publicity was “immaterial” and that it didn’t maintain money deposits or securities with the financial institution.

Group photo voltaic builders have been rattled by SVB’s collapse. The financial institution led or participated in practically two-thirds of all neighborhood photo voltaic tasks within the US thus far, in line with the financial institution’s web site.

“SVB was a trusted accomplice for local weather tech firms and infrastructure tasks,” stated Kiran Bhatraju, chief government of Arcadia, a neighborhood photo voltaic start-up, including it had moved most of its funds from SVB. Whereas Bhatraju stated he anticipated different firms to fill the trade’s new financing hole, “pipelines will likely be in flux for a while”.

Total, confidence within the cleantech sector stays excessive.

“There’s extra folks attempting to position cash than having locations to place it,” stated Aaron Halimi, chief government of Renewable Properties, a photo voltaic start-up primarily based in San Francisco. (Amanda Chu)

Energy Factors

-

Volkswagen picks Canada for a brand new battery plant to faucet into US subsidies after placing plans for Europe on maintain.

-

Brussels’ industrial plan to counter the US local weather regulation has kicked off an ideological battle.

-

Morocco’s financial system should adapt to satisfy the rising menace of local weather change, its finance minister warns.

-

Opinion: The US and its allies might want to make onerous selections to safe ample provide of uncommon earths.

Power Supply is written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu and Emily Goldberg. Attain us at power.supply@ft.com and comply with us on Twitter at @FTEnergy. Atone for previous editions of the e-newsletter right here.

Really useful newsletters for you

Ethical Cash — Our unmissable e-newsletter on socially accountable enterprise, sustainable finance and extra. Sign up here

The Local weather Graphic: Defined — Understanding an important local weather knowledge of the week. Enroll here

[ad_2]

Source link