[ad_1]

Obtain free Markets updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the most recent Markets information each morning.

US and European equities rose on Friday as firmer oil costs lifted vitality shares on each side of the Atlantic.

Wall Avenue’s benchmark S&P 500 superior 0.4 per cent and the tech-focused Nasdaq Composite gained 0.5 per cent.

The features have been echoed in Europe the place the region-wide Stoxx Europe 600 ended seven consecutive days of losses to complete 0.2 per cent greater.

Vitality shares posted sharp features on each continents after Brent crude rose 1.2 per cent to $90.94 a barrel, near its highest level since November. West Texas Intermediate, the US counterpart, rose 1.1 per cent to $87.82.

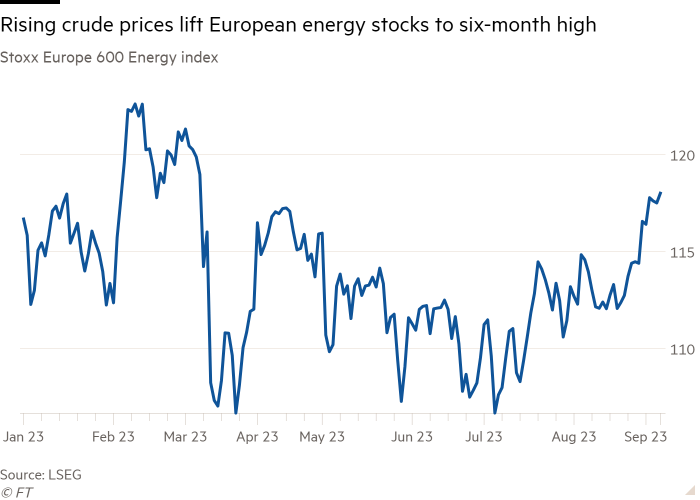

The S&P 500 Vitality index superior 1.5 per cent on Friday, whereas the Stoxx Europe 600 Vitality index rose 0.4 per cent, closing at its highest stage since March.

Oil costs have been climbing for the reason that begin of the week when two of the world’s prime producers, Saudi Arabia and Russia, introduced they might prolong provide cuts till the tip of this 12 months.

But analysts don’t “anticipate oil costs to float an excessive amount of upwards within the context of an total slowdown in financial development . . . and with the Chinese language financial system struggling to fulfill its development targets”, in keeping with Nadège Dufossé, world head of multi-asset at Candriam.

European and Chinese language shares declined on a weekly foundation, as each markets have been hit by a string of weak information that made traders fret over the prospect of a worldwide financial downturn.

A streak of bleak financial information releases signalled a continued decline in China’s exports and imports, in addition to a weakening companies sector in Europe.

European utilities shares rose 0.6 per cent, extending features from earlier this week as they are typically much less delicate to the financial cycle and so turn out to be extra enticing when traders anticipate a downturn.

The vast majority of traders assume that the European Central Financial institution will maintain again from additional tightening at its upcoming coverage assembly subsequent week, however some guess there are nonetheless extra rate of interest rises to come back earlier than the tip of this 12 months.

“We don’t assume the ECB will need to ‘shock’ the market, significantly in opposition to a backdrop of weakening financial information,” mentioned Paul Hollingsworth, chief European economist at BNP Paribas.

Asian markets edged decrease on Friday, with China’s benchmark CSI 300 down 0.5 per cent, whereas Japan’s Topix fell 1 per cent. Hong Kong markets have been shut due to storms and flooding.

A sell-off in Chinese language tech shares sharpened the drop following reviews that Beijing had banned central authorities officers from utilizing iPhones for work. Shares in Apple provider TSMC, the world’s largest contract chipmaker, dropped 0.6 per cent.

In the meantime, within the US, traders grew extra involved over the prospect of rates of interest staying greater for longer after contemporary information pointed to surprising resilience within the US companies sector and labour market.

Merchants are poised for the intently watched US inflation report due subsequent week within the hope of gaining extra perception into the Federal Reserve’s coverage plans greater than a 12 months after the central financial institution started to raise charges.

[ad_2]

Source link