[ad_1]

US equities dipped on the open on Wednesday after recent knowledge hinted at lingering inflation within the US and Europe, reinforcing investor issues that rates of interest will keep greater for longer.

The benchmark S&P 500 was down 0.2 per cent and the tech-heavy Nasdaq shed 0.3 per cent in New York following the discharge of the month-to-month Institute for Provide Administration’s buying managers’ index.

The index rose to 47.7, under analyst forecasts, however the report indicated that optimism for manufacturing exercise was rising and had rebounded from January.

The info level pushed the yield on the US 10-year Treasuries up 0.07 proportion factors to three.99 per cent. The yield on two-year notes, that are extra delicate to financial coverage, gained 0.08 proportion factors to 4.87 per cent.

Investor issues that international central banks can be pressured to maintain rates of interest greater for longer had been heightened by stronger than anticipated inflation knowledge from Germany, the eurozone’s greatest financial system.

Shopper costs rose 9.3 per cent in February 12 months on 12 months versus the 9.1 per cent forecast and echoed comparable sudden will increase in Spanish and French knowledge earlier within the week. The figures point out that European inflation is prone to persist forward of the publication of February euro space flash inflation knowledge on Thursday.

Europe’s region-wide Stoxx 600 closed down 0.8 per cent, Germany’s Dax fell 0.4 per cent and France’s Cac 40 dropped 0.5 per cent. The FTSE 100 rose 0.5 per cent.

“Within the morning we had the shock Chinese language manufacturing knowledge, however the German inflation prints have pivoted the narrative away from upbeat progress and extra in the direction of elevated and sticky inflation,” mentioned Laura Coopers, senior macro funding strategist at BlackRock’s iShares Emea.

“For the ECB, the truth that items and providers inflation is elevated creates situations to tighten even additional and the danger they’ll maintain on till they see significant disinflation.”

The yield on 10-year German bonds rose 0.01 proportion factors to 2.72 per cent.

“It was a reasonably dangerous month on the entire, with losses throughout equities, credit score, sovereign bonds and commodities,” mentioned analysts at Deutsche Financial institution. “That got here amidst rising concern about inflation, which led buyers to ramp up their expectations for central financial institution fee hikes.”

Traders will probably be watching subsequent week for the newest indicators on inflation from payroll and unemployment knowledge out of the US. Whereas the Federal Reserve has struck a persistently hawkish tone, officers on the European Central Financial institution have expressed variations in opinion, with governing council member François Villeroy de Galhau saying on Wednesday that it will be “fascinating” for charges to peak by summer time.

“You’d count on extra [diversity of opinion] within the ECB, as they should cope with nationwide biases, whereas the Federal Reserve solely has to take regional ones under consideration,” mentioned Neil Birrell, chief funding officer at Premier Miton.

Asian shares rallied on Wednesday as sturdy Chinese language manufacturing knowledge lifted investor spirits following muted buying and selling the day past.

Hong Kong’s Grasp Seng index closed up 4.2 per cent and China’s CSI 300 rose 1.4 per cent.

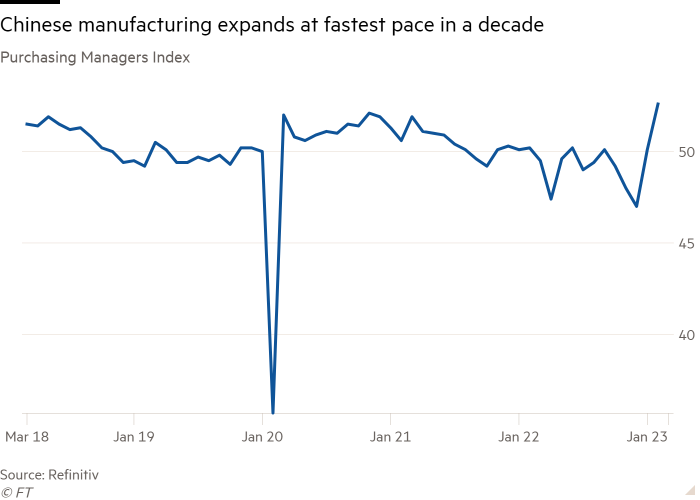

Figures launched on Wednesday confirmed that China’s manufacturing sector expanded at its quickest tempo in additional than a decade, in an unambiguous sign that its financial system was rebounding after the lifting of the punitive zero-Covid regime.

In accordance with China’s Nationwide Bureau of Statistics, the official manufacturing sector buying managers’ index was 52.6 final month, up from January’s 50.1 and better than economists’ expectations of fifty.5. A determine of greater than 50 signifies progress within the variety of firms reporting growth. The studying is at its highest stage since April 2012.

Chinese language households’ extra financial savings are additionally prone to speed up progress on the earth’s second-largest financial system, based on Citibank Asia analysts.

“China has returned to work with a way of urgency after the Chinese language new 12 months and with Covid issues behind. The sizeable extra family financial savings present a help for ‘revenge spending’ within the preliminary stage of the restoration,” they mentioned in a word.

The greenback fell 0.4 per cent, whereas the euro rose 0.9 per cent. Sterling rose 0.1 per cent, having fluctuated after Financial institution of England governor Andrew Bailey advised markets had been incorrect to consider many extra fee rises can be essential to tame inflation.

Nevertheless, analysts mentioned they anticipated the greenback to stay robust — the dollar is up 0.85 per cent this 12 months.

“I’m not satisfied it’s going to be a straight line down, if something there will probably be extra volatility,” mentioned Francesco Pesole, foreign exchange strategist at ING, in reference to the US foreign money. “General threat sentiment is simply too fragile to permit for a sustained downturn because the Federal Reserve story continues to be destructive and rhetoric is on the hawkish facet.”

Brent crude was up 0.1 per cent at $83.63 a barrel, whereas WTI, the US equal, misplaced 0.1 per cent, falling to $76.97.

[ad_2]

Source link