[ad_1]

US shares edged decrease on Monday, trimming early good points, as buyers weighed a much-anticipated product launch from tech large Apple and continued trying to find clues concerning the future path of rate of interest rises.

Wall Avenue’s S&P 500 closed down 0.2 per cent, paring a small advance that had lifted the benchmark index greater than a fifth above a current low in October 2022 — briefly taking it into technical bull-market territory.

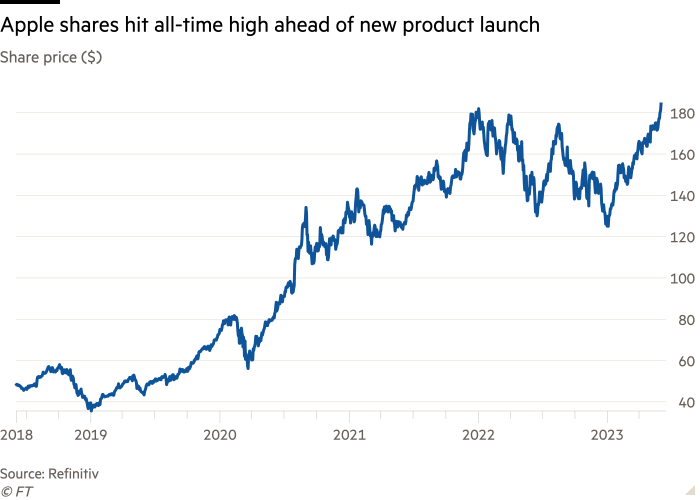

Apple’s shares slid 0.8 per cent after the group unveiled a brand new “mixed-reality” headset, following good points of as a lot as 2.2 per cent within the run-up to the product launch.

The Nasdaq Composite edged 0.1 per cent decrease because the weeks-long tech rally took a breather.

The strikes in fairness markets got here as contemporary knowledge from the Institute for Provide Administration on Monday confirmed exercise within the huge US providers sector slowed in Could, as new orders softened underneath the load of excessive borrowing prices.

Additional damping sentiment on Wall Avenue was a grim earnings forecast by Morgan Stanley analysts who projected a 16 per cent decline in earnings per share for the S&P 500 to $185 in 2023 in comparison with a yr in the past.

The financial institution’s fairness strategists count on company America to expertise slowing income progress and margin contraction due to tighter credit score circumstances within the wake of the US’s current regional banking turmoil.

In authorities debt markets, the yield on the 10-year US Treasury observe was flat at 3.7 per cent, whereas the shorter-dated two-year yield slipped 0.03 proportion factors decrease to 4.48 per cent — reflecting an ongoing “inversion” of the yield curve.

Elsewhere in inventory markets, Europe’s regional Stoxx 600 closed 0.5 per cent decrease, whereas France’s CAC 40 misplaced 1 per cent and Germany’s Dax shed 0.5 per cent.

The small losses got here after European Central Financial institution president Christine Lagarde mentioned in a speech that underlying value pressures remained sturdy within the eurozone, a sign that policymakers have been prone to proceed elevating charges. The ECB is subsequent because of announce a charge choice on June 15.

The Federal Reserve will make its personal rate of interest announcement on June 14. The US central financial institution has taken rates of interest up from close to zero in early 2022 to a “goal vary” of 5 per cent to five.25 per cent in an try and curb inflation.

Brent, the worldwide benchmark, jumped as a lot as 3.6 per cent after Saudi Arabia mentioned it might minimize oil manufacturing by 1mn barrels a day, however pared again its good points to commerce 0.4 per cent increased at $76.41 a barrel.

West Texas Intermediate, the US marker, rose 4.6 per cent earlier than settling about 0.1 per cent increased, at $71.83. London’s energy-heavy FTSE 100 misplaced 0.1 per cent, unable to carry on to earlier good points.

Asia’s markets have been broadly up, with Japan’s benchmark Topix inventory index rising 1.7 per cent and Hong Kong’s Grasp Seng index advancing 0.8 per cent. Chinese language equities bucked the upward pattern, with the CSI 300 index of Shanghai- and Shenzhen-listed shares down 0.5 per cent.

Official media in China additionally referred to as on buyers to place confidence in the nation’s home inventory market, with the state-run Financial Every day suggesting that “clear-headed understanding, staunch confidence, resoluteness and persistence” have been the “chief obligations of all market members”.

The Turkish lira prolonged its losses to hit a brand new file low of TL21.3 in opposition to the greenback on Monday, regardless of the current appointment of investor favorite Mehmet Şimşek as finance and treasury minister.

The transfer initially sparked hopes that Turkey’s president, Recep Tayyip Erdoğan, was getting ready to vary course on his unorthodox economics, which many blame for triggering an acute price of dwelling disaster that drove the lira decrease.

[ad_2]

Source link