[ad_1]

You’re excited about driving for Uber, Lyft, or different corporations like Instacart or Uber Eats, however you’re unsure for those who want further insurance coverage. You’re in the suitable place. We’ll stroll you thru the whole lot you should learn about rideshare insurance coverage.

Whether or not you’re paying down debt, saving cash or simply making an attempt to make ends meet, driving for rideshare corporations could be a good way to make progress in your monetary targets. However you want the suitable protection. Or your dream of additional cash may flip right into a draining nightmare.

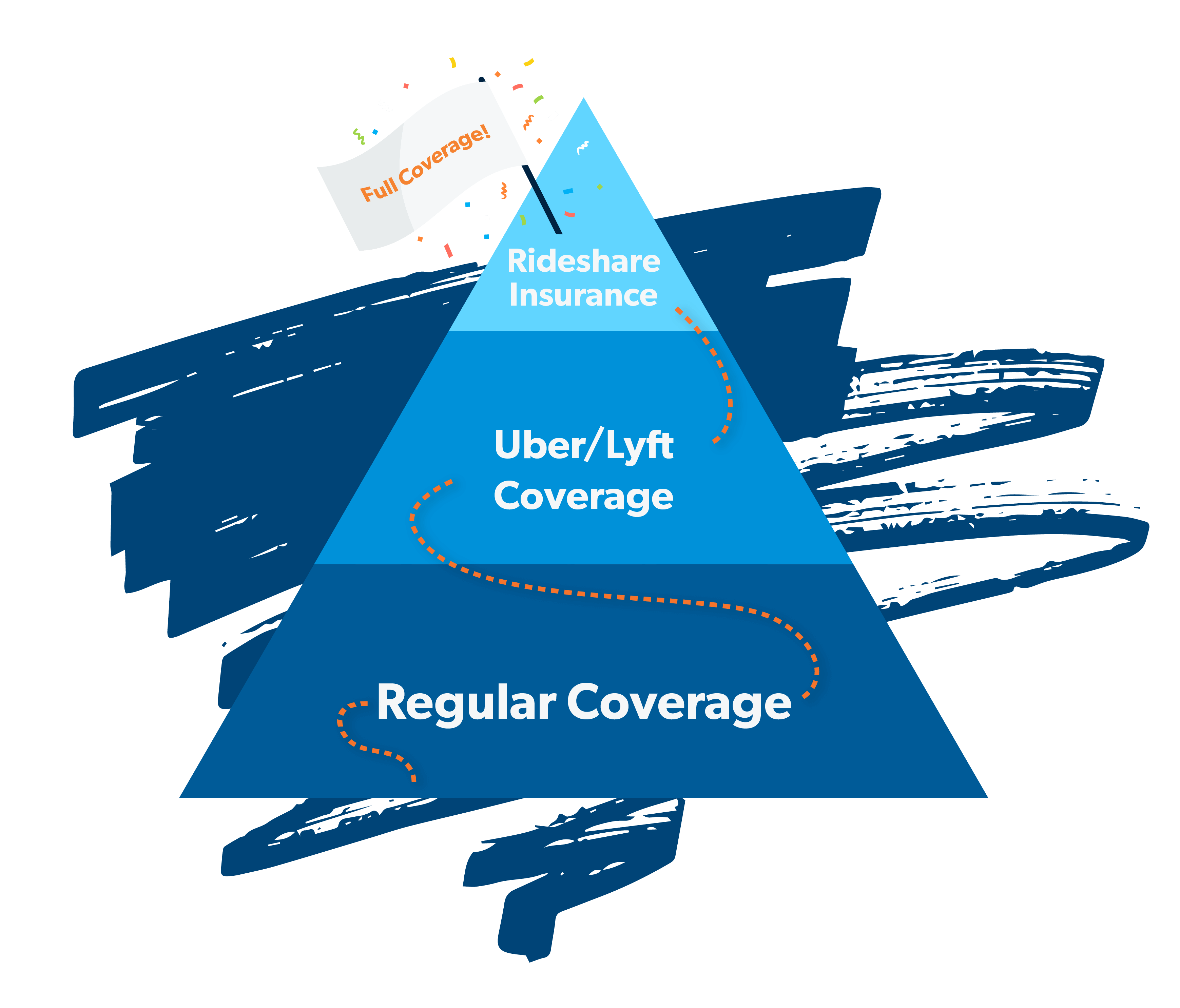

Right here’s why. Your private auto coverage doesn’t cowl driving for Uber or Lyft. And Uber or Lyft insurance coverage doesn’t present full protection. So for those who hit somebody, like whereas ready for a journey request to return in, you received’t be coated. You’d must pay out of pocket. Not good. Because of this you want rideshare insurance coverage.

However right here’s the excellent news. Rideshare insurance coverage isn’t as a lot as you may suppose. The common price is between $10 and $20 further per 30 days.

What Is Rideshare Insurance coverage?

Rideshare insurance coverage is an add-on to your regular auto insurance coverage coverage that protects you whenever you’re driving for a corporation like Uber or Lyft. Since rideshare drivers are technically unbiased contractors (you’re employed for your self, not Lyft or Uber), you need to fill a number of the insurance coverage gaps by yourself. It’s an additional layer of safety in case one thing occurs whilst you’re on the clock.

![]()

Do not let automotive insurance coverage prices get you down! Obtain our guidelines for straightforward methods to save lots of.

If you happen to’re hauling folks or meals, you want it. Actually, in case your insurance coverage provider finds out you’re utilizing your car for rideshare gigs, they may cancel your coverage. Ouch.

What Do Uber and Lyft Cowl?

That is the place it will get a little bit difficult. However stick with us.

Rideshare corporations do present some protection, however it’s solely throughout sure instances. Principally, rideshare corporations are like that buddy who doesn’t supply to assist pay for the meal however pitches in with the tip.

Rideshare corporations break down the instances you’re working and instances you’re not into what are known as durations. Right here’s the way it works.

Interval 0—Your app is off and your private coverage is energetic.

Interval 1—Your app is on however you’re ready for a journey. Your private coverage received’t cowl you so that you’ll want further rideshare insurance coverage.

Interval 2—You settle for the request and also you’re on the way in which to select the passenger up. Your rideshare insurance coverage kicks in with legal responsibility at $1 million.

Interval 3—Your passenger is in your automotive and also you’re dropping them off on the mall or bar, or perhaps even to their ex-girlfriend’s residence to attempt to woo them again. (Stranger issues have occurred on this planet of ridesharing!) Once more, Uber and Lyft cowl you throughout this time.

Additionally notice that Uber and Lyft do have minor variations in the case of the deductible (the quantity you pay earlier than the insurance coverage kicks in). However both manner, you continue to want that further rideshare coverage.

What Do Different Supply App Companies Cowl?

On the subject of different supply app corporations (Uber Eats, Grubhub, Instacart, and so on.), they’re fairly hit and miss in the case of their protection. Grubhub and Instacart don’t supply insurance coverage. You’re by yourself. DoorDash affords legal responsibility provided that the meals is in your automotive.

Learn the superb print for those who’re planning to work with any of those different providers and ensure your rideshare insurance coverage fills all of the gaps.

Learn how to Get Rideshare Insurance coverage

First, for those who’re updating your coverage by your self, inform your current insurance coverage provider you intend to drive for Uber or Lyft. Ask in the event that they promote rideshare insurance coverage. Not each provider does. If it’s not obtainable, you may must get business insurance coverage.

Subsequent, ask for a quote and examine charges. Rideshare insurance coverage is a kind of add-on coverage, which means it’s not a stand-alone factor you may simply purchase anyplace. It needs to be added to an current coverage. (In different phrases, you may’t have private protection from Geico and get rideshare insurance coverage from Allstate.)

If all of this makes you type of nervous, among the best methods to ensure you’re coated is to work with a trusted agent who can stroll you thru precisely what you want.

Our staff of trusted insurance coverage brokers known as Endorsed Native Suppliers (ELPs) might help you discover the perfect rideshare package deal so you will get going along with your aspect hustle. Don’t let a little bit insurance coverage glitch cease you from getting on the street and crushing your monetary targets. Get began at the moment with free quotes from an area agent.

[ad_2]

Source link