[ad_1]

Two of the world’s largest gold miners are in talks to create a worldwide powerhouse for producing the dear steel within the largest takeover provide introduced this yr.

US-listed Newmont, already the world’s largest gold miner by output, has launched an all-share bid for its Australian rival Newcrest that values the smaller firm at nearly A$24bn ($17bn).

The transfer might kick-start a bidding battle for Newcrest, Australia’s largest gold mining participant. Analysts say rivals together with Canada’s Barrick Gold and Agnico Eagle are additionally looking to consolidate the market.

Newcrest shares gained 10 per cent to A$24.74 on the information, reaching their highest stage since Could.

Newmont’s A$24bn provide for Newcrest could be the most important M&A deal introduced to date this yr, in accordance with information from Dealogic, simply outstripping the $7.5bn acquisition of water therapy firm Evoqua by expertise group Xylem introduced final month.

Newmont’s provide implies a 21 per cent premium to Newcrest’s final closing share value.

Tom Palmer, the Australian chief government of Denver-based Newmont, mentioned the deal was conditional on approval from Newcrest’s board and regulators.

“We imagine a mix of Newmont and Newcrest presents a robust worth proposition to our respective shareholders, workforce and the communities by which we function,” he mentioned.

The mixture would reunite the 2 firms after nearly 1 / 4 of a century. Melbourne-based Newcrest was established within the Sixties as Newmont’s Australia arm and was spun out in 1990 after it merged with BHP’s historic gold belongings.

The mixture of the traditionally linked firms would put 4 of Australia’s 5 largest gold mines underneath the management of 1 firm and require Australian authorities approval.

Information of the talks was first reported by the Australian Monetary Evaluate.

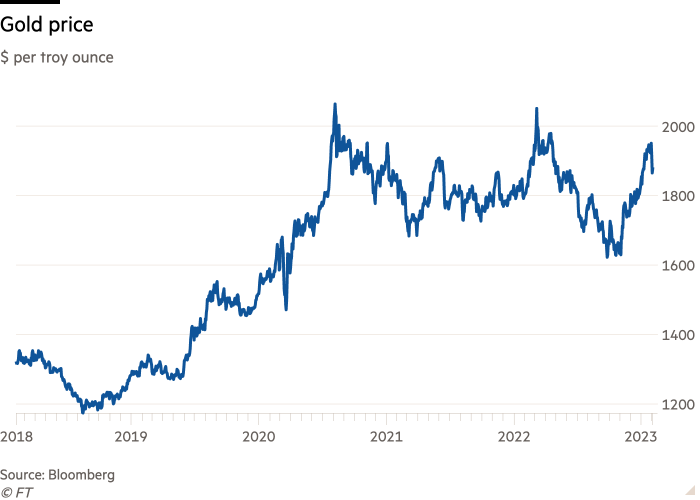

A mixture of rising prices in Australia’s mining sector, manufacturing points for gold and volatility in its value as rates of interest have risen sharply has pushed extra firms to contemplate offers to spice up their scale.

Property in steady international locations equivalent to Australia and Canada have come into focus. OZ Minerals, the south Australian nickel, copper and gold miner, is close to being acquired by BHP for $6.4bn, whereas Canada’s Yamana Gold is being damaged up after Agnico Eagle and Pan American Silver paid $4.8bn to accumulate the corporate.

Newcrest is a bigger goal for the gold sector’s largest firms. It has mines in Australia, Canada and Papua New Guinea, and has been on the radar of each Newmont and Barrick in recent times. It has grow to be a goal once more after its inventory almost halved in worth between April and September final yr. Its long-serving chief government Sandeep Biswas stepped down in December and the corporate has but to call a everlasting alternative.

Newcrest mentioned that it had already rejected one bid as being too low, however it didn’t rule out participating with its bigger rival, which submitted the next indicative bid on Sunday.

The brand new proposal, which might provide 0.38 Newmont shares for each Newcrest share, would additionally embody a plan to checklist Newmont on the Australian Inventory Alternate. Newmont shareholders would management 70 per cent of the mixed firm to Newcrest’s 30 per cent.

Simon Mawhinney, chief funding officer of Newcrest’s largest shareholder Allan Grey, mentioned he wouldn’t assist a takeover by Newmont based mostly on the phrases proposed.

“Newcrest may be very low-cost. There’s dilution danger,” he mentioned. “The merger ratio is just too cute by half,” he mentioned, noting that the Australian firm was nicely funded and that its long-life gold reserves ought to be extremely precious.

Mitch Ryan, an analyst with Jefferies, mentioned the strategy might shake out different bidders, with Barrick linked with a takeover in 2018. “Whereas no formal indication has been given, additional curiosity from different suitors is feasible.” he mentioned.

Newcrest, which is being suggested by JPMorgan and Gresham Advisory Companions, mentioned it might contemplate the brand new bid. Newmont is being suggested by Financial institution of America, Centerview Companions and Lazard.

Further reporting by Hudson Lockett in Hong Kong

[ad_2]

Source link