[ad_1]

For Jason Macaree, a butcher within the English city of Rochford, money is coming again.

Rochford in Essex is one among two cities — the opposite is Cambuslang, exterior Glasgow — chosen to run a pilot challenge to enhance entry to money as banks shut branches to chop prices. Below the scheme, lenders collectively present employees on a rotating foundation at hubs operated by postmasters.

For a lot of of Macaree’s prospects, the hub, which was launched early in 2021, has develop into a lifeline. Money now makes up as a lot as 50 per cent of his day by day takings, round twice as a lot as the identical time of 12 months in 2021.

“Individuals discover it a lot simpler to price range with money of their pocket, and everybody’s on a tighter price range,” he mentioned, including that for enterprise it was additionally essential for paying suppliers.

The coronavirus pandemic accelerated a longer-term pattern of shifting in direction of a extra cashless society, with bricks-and-mortar retailers and the hospitality sector embracing digital funds.

However throughout the price of residing disaster, an growing variety of households are turning to cash as a budgeting tool as they battle to deal with hovering worth rises.

Nevertheless, many have struggled to entry cash and notes as banks close large parts of their high street networks as a part of a cost-cutting drive that has left fewer than 6,000 branches throughout the UK, lower than half the variety of 20 years in the past.

“We’re in a monetary local weather the place individuals who didn’t care about budgeting at the moment are having to,” mentioned Derek French, a former financial institution govt who headed the Marketing campaign for Group Banking Companies. “The [cash access] drawback is gaining floor, and the treatments are usually not occurring wherever close to quick sufficient.”

In 2018, the impartial Entry to Money evaluation, funded by ATM operator Hyperlink, started exploring protect money, with the financial institution hubs proving to be its most profitable tasks.

The UK authorities first mentioned it will legislate to guard money entry within the 2020 spring Price range. Nevertheless, the Monetary Conduct Authority watchdog is barely resulting from acquire the powers to enforce that duty with the monetary providers and markets invoice that’s at the moment going via parliament.

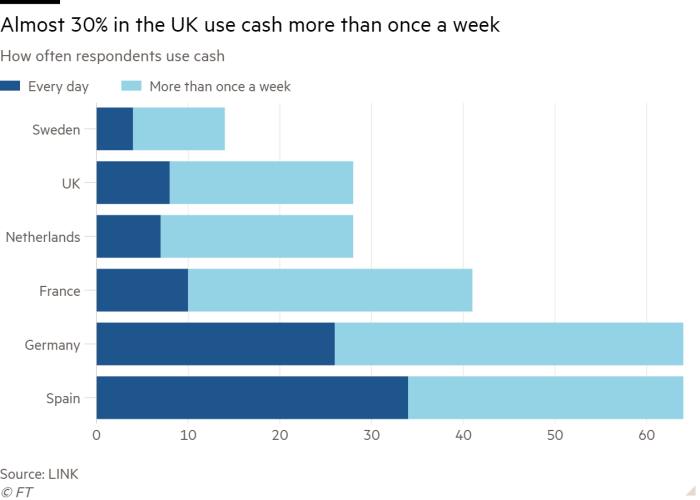

With greater than 1 / 4 of individuals within the UK utilizing money greater than as soon as every week and virtually 10 per cent, or round 5mn, utilizing it day by day, campaigners warn that upcoming laws on money entry should be strengthened to guard them.

Final month, the chief of the UK’s monetary regulator criticised banks for being too sluggish in rolling out banking hubs. “We need to see banking hubs and various types of provision accelerated,” mentioned Nikhil Rathi, the FCA’s chief govt.

Jaime Bush, proprietor of The Sq., a café in Rochford, mentioned the pilot hub had develop into essential for his enterprise. “We have now a variety of the older technology coming in particularly on Tuesday [when Rochford has its market day],” he mentioned. With out entry to the hub, he must make a 40-minute spherical journey by prepare to the closest metropolis, Southend-on-Sea, to deposit his takings.

“It’s additionally helpful for change — the entire register could be empty by noon.”

However new hubs have been sluggish to get began. Two opened their doorways earlier this month in Brixham, Devon, and Cottingham, Yorkshire — the primary to launch because the pilot scheme regardless of the announcement of 27 deliberate websites over the previous 12 months.

French estimates that there are at the very least 100-150 communities throughout the UK that want a hub and he anticipates that quantity will improve. He mentioned the pilots had already proven there have been wider advantages to providing banking providers, equivalent to reviving struggling excessive streets.

“The [Access to Cash review in December] was very conclusive — hubs not solely serve people’ money wants, however introduced footfall again to cities, which was vastly useful for everybody.”

Frustration over the sluggish rollout of hubs is partly resulting from complexities of the mannequin, in keeping with Natalie Ceeney, who chairs the Money Motion Group that led the pilots.

“Organising new providers takes time, particularly when this includes banks becoming a member of forces to share new infrastructure,” she mentioned.

Jeff Mitchell at CleanSlate, a not-for-profit group that works with lower- revenue households, warned that though the pandemic had made money much less related for a lot of retailers and enterprise within the hospitality sector, it remained essential for many individuals.

“Pubs, bars or eating places which are card-only . . . reinforce the false assumption that everybody can stay their lives that method.”

In line with the British Retail Consortium, money accounts for 15 per cent of retail spending, with among the UK’s largest grocery store chains, together with Aldi and Tesco, operating trials with cash-free and checkout-less shops.

However international locations farther down the street in direction of a cash-free society, equivalent to Sweden, have found the challenges of this method. The diminishing variety of retailers accepting notes and cash means about 600,000 of the nation’s 10mn inhabitants battle day by day, mentioned Gabriela Guibourg, head of research and coverage on the Riksbank, the Swedish central financial institution.

“We do get a variety of calls . . . saying ‘how am I going to deal with this?’, particularly from the very aged,” she mentioned. “These individuals must have entry to cheap fee.”

The UK Treasury mentioned it was “completely dedicated” to defending entry to money, and Rishi Sunak, the prime minister, advised MPs on Wednesday that the laws within the monetary providers and markets invoice represented a “vital intervention” and remained a precedence for his authorities.

However French urged ministers to provide the FCA extra energy in order that banks would velocity up the institution of extra hubs.

“The laws is a very long time coming and it’s not as robust appropriately — in the event you’re chargeable for these items within the financial institution, you’ll be rubbing your fingers and saying ‘let [the status quo] go on’.”

[ad_2]

Source link