[ad_1]

After Russian President Vladimir Putin introduced the nation’s invasion of Ukraine final February, Natalia Smirnova’s cellphone began ringing off the hook. The monetary adviser’s Russian purchasers have been panicking. “Ought to I purchase gold?” one requested her. “If worst involves worst, not less than I can bury it.”

That angle was shared by many — and turned Russia into an surprising nation of gold bugs nearly in a single day.

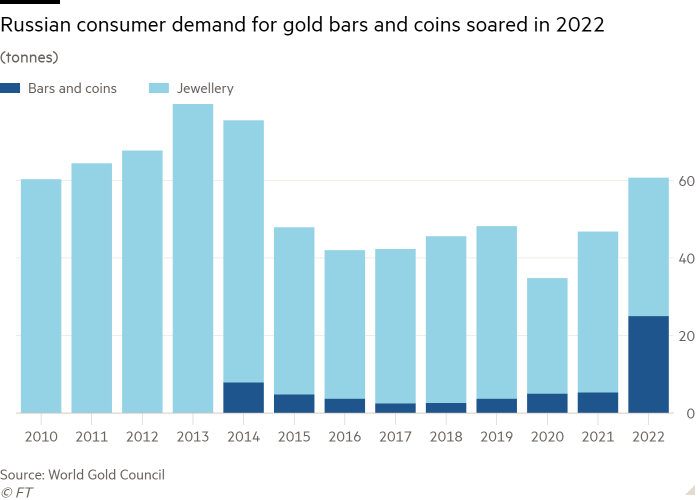

Demand for gold bars and cash final yr grew quicker in Russia than in another nation, rising to almost 5 occasions the extent of the earlier yr, based on information from the World Gold Council.

Whereas Russia has lengthy been one of many world’s largest gold producers, accounting for nearly a tenth of worldwide manufacturing, its retail buyers have traditionally shunned the metallic, partly as a result of a 20 per cent worth added tax on purchases of bars.

Folks often turned to {dollars} and euros throughout occasions of bother. However that has all modified.

“Non-public residents are in search of a method to economize, and euros and {dollars} are briefly provide, so the recognition of gold has surged,” mentioned Vitaly Nesis, chief govt of Polymetal, an Anglo-Russian gold producer. “So long as we expertise geopolitical instability, the demand for gold could also be vital.”

The change to gold has been strongly inspired by the Russian authorities.

The central financial institution in March restricted gross sales of overseas forex, and on the identical day Putin scrapped VAT on gold bar purchases, sparking a surge in shopping for.

Finance minister Anton Siluanov advised Russians that the greenback was “risky” and uncovered to “varied dangers”, highlighting that valuable metals have been a lovely various. “Investing in gold might be an incredible various to {dollars} amid an unstable geopolitical state of affairs,” he mentioned in a press launch in March.

Russian consumers have been quickly queueing for gold. As banks rushed to satisfy demand for the smaller bars most well-liked by retail buyers, Sberbank, an enormous state-owned financial institution, warned its clients a couple of potential scarcity of the smaller sizes. Sberbank accounts for about 80 per cent of gold bars and cash bought in Russia, based on its press workplace.

In Russia, many authorised sellers can distribute cash however solely banks are allowed to promote bars. Regardless of this, private commercials of second-hand bars flooded Avito, the nation’s main on-line market for used items.

To calm the frenzy, the Russian central financial institution stopped shopping for gold on March 15 — two weeks after its first gold buy in two years — however resumed 10 days later. “The market was disoriented,” the financial institution’s first deputy governor, Alexei Zabotkin, mentioned later by the use of clarification for the financial institution’s exercise.

In 2022, world gold demand rose 18 per cent to its highest degree in additional than a decade, propelled by massive purchases from central banks, as nations sought to diversify away from the greenback.

Trade analysts imagine the Russian central financial institution was a major purchaser, however they aren’t sure as a result of the establishment stopped reporting its reserves quickly after the conflict in Ukraine started.

Gold costs rose nearly 20 per cent from their trough in November to the top of January, fuelled partly by purchases from Asia and Russia, based on Bernard Dahdah, commodities analyst at Natixis.

“There’s lots of effort by Russia and China to make the greenback [less influential] — to cease it from being the petrodollar,” he mentioned.

The worth has fallen 4.4 per cent this month as euphoria about China’s post-coronavirus reopening has waned.

The current coverage adjustments in Russia are just like the way in which China opened up its gold market originally of the 2008 monetary disaster, he mentioned. “The Chinese language made it a lot simpler for buyers to purchase into gold. And that’s once we noticed the growth.”

Regardless of final yr’s surge, Russian demand for gold bars and cash final yr was solely 2 per cent of the worldwide whole, based on World Gold Council information. China, at 19 per cent, stays the world’s greatest purchaser, adopted by Germany and India.

Russian gold miners are additionally determined to seek out new consumers as individuals search to diversify their financial savings. Earlier than the conflict, Russia consumed only a fifth of its gold, exporting the remainder.

In the direction of the top of 2022, Russia succeeded in redirecting gold exports to Asia, particularly China, mentioned Valery Yemelyanov, inventory market analyst at BCS World of Investments. Russian gold exports to China skyrocketed by 63 per cent, rising $150mn yr on yr, Chinese language customs information exhibits.

Underneath-developed infrastructure for retail gold funding might, nevertheless, dampen public enthusiasm. Folks can solely promote the bars again to banks, for instance.

Storing gold is one other situation as a result of many individuals retailer gold at house. Each scratch can cut back the worth of a gold bar, mentioned Smirnova, the monetary advisor. “Not everybody understands they can not preserve bars in a shoebox.”

[ad_2]

Source link